09/01/20193 mins

Manager’s Outlook 2019

In my youth, I read The Ragged Trousered Philanthropists by Robert Tressell. Looking back, the book presented socialist ideas in a more digestible form and the title was meant to illustrate the irony of poverty stricken ‘philanthropists’ performing gruelling work for inadequate pay on behalf of avaricious masters.

I always considered the title very clever, as it summed up the thrust of the book, and as I look at today’s stockmarket, I wonder if the author would have managed a wry smile at the gigantic malinvestment in the ecommerce area. Today, investors are acting as philanthropists as they subsidise unprofitable user growth by ‘disruptive’ entrants in a variety of areas. Investments connected with internet shopping, food delivery, ride hailing services, scooter rentals, music streaming and video streaming, to name just some, are strongly favoured by investors despite their continued propensity to burn cash. That the consumer appreciates a service sold below the cost of production is not a surprise. The challenge is converting a subsidised, or free service, to a sustainably profitable business model. The lack of scepticism about the difficulty of achieving this is a symptom of ten years of cheap money.

In recent reviews, I have noted some concern with regard to investor attitudes to risk driven by a fear of missing out. The mania for cryptocurrency get-rich-quick schemes proved to be brief but was concerning as it represented a proxy for both the ease and speculative nature of financial conditions. The investor infatuation with all things technological was also highlighted as a concern as the area appeared to be awash with both cash and excessive optimism. The premium smartphone boom has peaked, social media is now subject to increasing regulatory pressure and the ecommerce business model will have to evolve further. We have minimal exposure to these areas as we see elevated expectations and thus scope for disappointment.

It is now increasingly popular for politicians to pledge tax cuts and increased spending in anticipation of these actions generating improved future growth (and hence tax revenues). This may well prove correct but, equally, once politicians get a taste for this type of strategy, it is the first step on the road to currency debasement via inflation. That said, this is likely to be a lengthy journey, as a large number of stakeholders favour the status quo.

Generally speaking, the spread of valuations across the market is wide and we continue to identify opportunities that we believe will generate good long-term returns for shareholders.

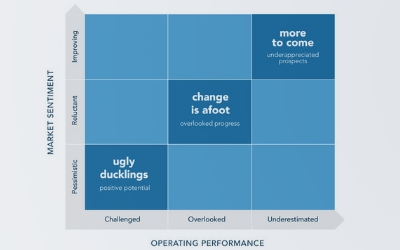

As I have previously noted, as contrarian investors we actively seek unfashionable and unpopular investments that we believe can recover. This is where we find the best balance between risk (expectations are low) and reward (things can get better). Our investment approach is designed to anticipate and benefit from change and we will continue to seek out opportunities with potential to profit the long-term investor.

Alasdair McKinnon

*15 December 2018

Please remember that past performance may not be repeated and is not a guide for future performance. The value of shares and the income from them can go down as well as up as a result of market and currency fluctuations. You may not get back the amount you invest.

The Scottish Investment Trust PLC has a long-term policy of borrowing money to invest in equities in the expectation that this will improve returns for shareholders. However, should markets fall these borrowings would magnify any losses on these investments. This may mean you get back nothing at all.

Investment trusts are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

Please note that SIT Savings Ltd is not authorised to provide advice to individual investors and nothing in this article should be considered to be or relied upon as constituting investment advice. If you are unsure about the suitability of an investment, you should contact your financial advisor.