05/03/20203 mins

Taps back on: more cheap money from the Fed

If you were to pinpoint the most momentous market events in 2019, you might say Brexit – or the lingering trade war between the US and China. For us, the actions of the US Federal Reserve (Fed) were the most significant.

Last year, the Fed had some tough choices to make. After a decade of incredibly low interest rates, policymakers had begun to wean the world from quantitative easing (cheap money) and had started to raise rates. Markets didn’t react well to policymakers stemming the flow of cheap money. Neither did President Trump, who took to Twitter to vent his ire. In response, the Fed turned the tap back on, and cut interest rates again. US stocks soared, and investors applauded.

This is becoming a familiar pattern. Amid coronavirus fears, the Fed swung into action yet again, making an emergency rate cut of 0.5%. The cut came mere hours after President Trump tweeted more criticism of the Fed, exhorting it to “ease and cut rates big”. Although it’s ostensibly independent, the Fed appears to be bending to the political wind. And because President Trump sees stockmarket performance as a key measure of his success, this might not be the last time that the Fed jumps in.

Cheap money – helpful or harmful?

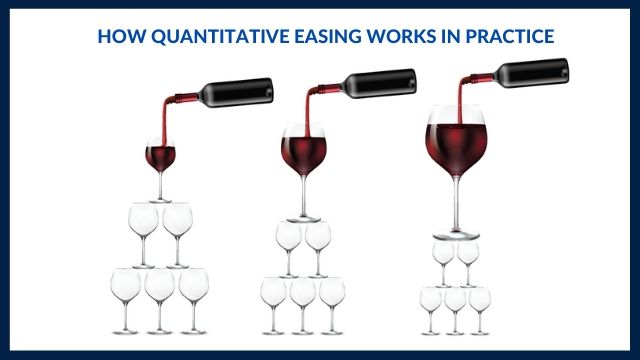

What are the long-term consequences of the Fed’s largesse? The big picture idea behind accommodative policies is to encourage lending, with the wealth trickling down through society. In reality, cheap money has flowed into speculative trends, enriching a relatively small segment of the population. Meanwhile, others in society struggle to afford practical assets, like housing. As wealth inequality grows, voters are more likely to turn to maverick candidates at the ballot box. This latest shot in the arm from the Fed will do little to alleviate these issues.

An unintended consequence of cheap money is a tendency to invest almost like spending Monopoly money. Cash has been pouring into assets and themes that look, to us, wildly speculative. WeWork is a recent example of this – selling itself as a pioneering property/technology company, while at heart it was a middle-man carrying too much debt. This sort of ‘emperor’s new clothes’ scenario is by no means uncommon.

It’s so important to look beyond the hype at the quality of underlying business and judge the investment case dispassionately. While we don’t have all the answers about coronavirus, we do know that the flow of cheap money won’t cure it for sure. That’s why we’ll not expose our portfolio to overvalued investment themes, a by-product of this easy money environment, and look for underappreciated stocks and sectors instead.

Please remember that past performance may not be repeated and is not a guide for future performance. The value of shares and the income from them can go down as well as up as a result of market and currency fluctuations. You may not get back the amount you invest.

Please note that SIT Savings Ltd is not authorised to provide advice to individual investors and nothing in this article should be considered to be or relied upon as constituting investment advice. If you are unsure about the suitability of an investment, you should contact your financial advisor.