29/06/20203 mins

Lessons in life – taking the contrarian view

“If you can keep your head when all about you

are losing theirs and blaming it on you,

if you can trust yourself when all men doubt you,

but make allowance for their doubting too”

So begins Rudyard Kipling’s famous poem, ‘If’. Intended, in its day, as life advice for young men, it also contains an important lesson for investors – one that’s at the heart of every potentially damaging boom and bust cycle. The poem highlights the value of calmness in the face of adversity, and in having the faith to stand apart, instead of merely following the herd.

Kipling published those words in 1910, but human nature hasn’t changed at all since then. In stressful situations it is easy to lose objectivity and give in, quite understandably, to fear-based decision making. We saw this most recently when news broke of the Covid-19 pandemic. Investors reacted, en masse, to the fear of the unknown – and the possibility of a permanent loss of capital. This phenomenon is a result of the human tendency, hardwired into us, to retreat to the perceived safety of the crowd.

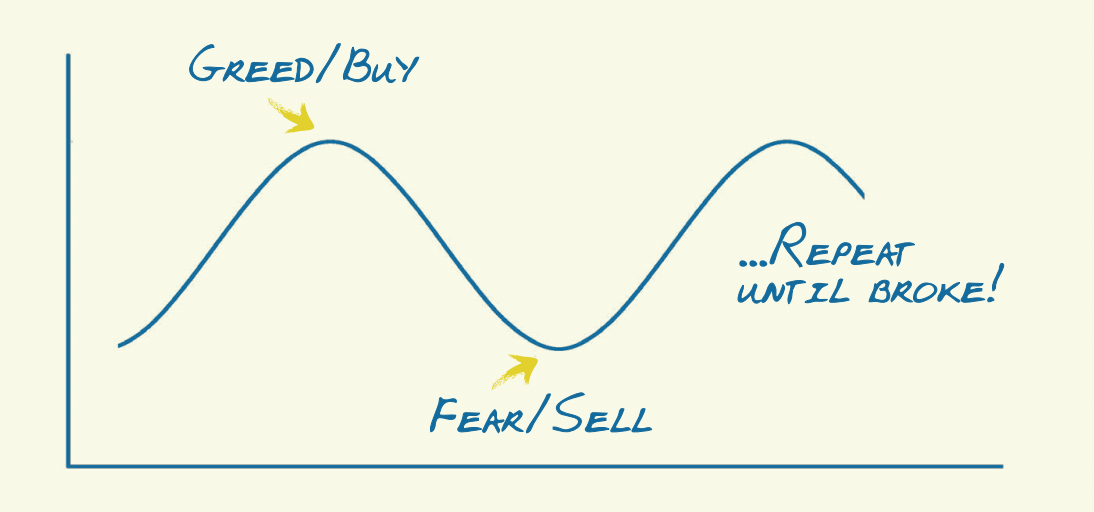

But all too often this impulse leads to groupthink, with investors buying or selling assets at precisely the wrong time. Behavioural economists commonly refer to this as the ‘cycle of emotion’ which we think is quite nicely demonstrated in the chart below…

When all’s well with the world, and assets are appreciating, people tend to feel optimistic and invest more. The ‘fear of missing out’ can then take hold, which leads to even more investing in, what are starting to be, very popular investments. In this phase, optimism can turn into euphoria and may characterise the peak in the market or even an asset bubble. Yet investors continue to buy, heedless of the warning signs that the most advantageous time to do so has passed. And of course, when sentiment eventually fades, the process goes into reverse and bullishness is replaced with fear, and eventually panic. At this point, investors will have a tendency to sell, even if it’s not necessarily in their best interests to do so.

We’ve seen this cycle repeated time and again, because investor behaviour, far from being correlated to the facts, can be irrational. For a recent example of this, look no further than investors’ extraordinary partiality for Zoom Technologies, based it would appear on little research. Shares, in Zoom, soared as they were snapped up by investors thinking that this was the company made famous by the surge in demand for video conference calling, widely used in our shift to working from home. However, it turned out that what they were actually investing in was a completely unrelated Chinese stock. Buying the name, and the wrong one at that. Needless to say, there was an equally swift dash for the exit.

Being caught up in the hype of the crowd is one side of investing that our contrarian philosophy seeks to avoid. We like to take our time and objectively analyse the market to unearth the hidden gems that are underappreciated by others. It’s about seeing a spark for improvement that others have missed. That could be a change in management; the balance sheet strength that will see the company through hard times; or a sustainable dividend yield, all of which can be indicative of a company’s future wellbeing.

The financial health of companies is more important now than ever. Not all will emerge from the pandemic unscathed and the fallout from the economic slump will be long lasting. The Covid-19 pandemic will trigger huge change in the way we live, work and think. Adaptation will be required including, for example, in the organisation of global supply chains, where goods and services may well be sourced closer to home in future (ie. ‘nearshoring’). Ultimately, we expect the economy to recoup with equity markets likely to lead that recovery.

It is our view that patience is key to riding out the heightened volatility we are seeing in markets at present. As investors, we do always look to learn from past experiences. Sir John Templeton, once noted that, “the four most expensive words in the English language are ‘this time it’s different’”. It never is – circumstances change, but hardwired emotional responses lead to patterns of wealth and loss. The key to successful long-term investing is to carefully research and have a clear rationale behind each decision.

Please remember that past performance may not be repeated and is not a guide for future performance. The value of shares and the income from them can go down as well as up as a result of market and currency fluctuations. You may not get back the amount you invest.

The Scottish Investment Trust PLC has a long-term policy of borrowing money to invest in equities in the expectation that this will improve returns for shareholders. However, should markets fall these borrowings would magnify any losses on these investments.